Retirement Planning vs Wealth Building

Some quick tips...

Tip 1: Take advantage of the company match. If your company doesn't provide a pension then it should provide a 401k plan and some kind of company match. The companies we have worked for match up to 6% of what we put into our 401k, some match less, some match more. We actually contribute 10% and the companies we work for match 4% for an annual savings of 14% a year. I recently bumped my contribution from 8% to 10%, which turned out to be another $40 out of my paycheck. Some people have an easier time of saving if the $$$ never reaches their bank account.

Tip 2: Contribute to Roth if you can. We try to contribute to Roth IRA as much as possible. Why? Because it allows us to diversify our tax risk. Roth IRA withdrawals aren't taxable, so when we hit that 60+ age we can withdraw from both our 401k and our Roth. The Roth portion isn't taxable so we can use it to keep out of the higher tax brackets. For example if we take out $60,000 from our 401k and $40,000 from Roth, our taxable income is only $60,000.

Tip 3: Before you begin investing, do your homework. Figure out how much risk you are willing to take on and what kind of vehicles you like. If you are risk averse go with the CDs, on the opposite end if you love risk, play with penny stocks. Of course there is a happy medium which all the financial advisors tout called portfolio diversification but that is based on individual needs.

Tip 4: Take a look at your companies Employee stock purchase plan if it has one. Most give a standard discount of 15% when you buy it through the ESPP. For a stock thats at $50, you are buying it $42.50. That is free $$$ right off the bat.

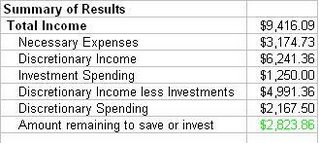

So how do we divide our income between retirement savings and investing vehicles?

Retirement10% of our income goes to 401k, +4% company match. I put in $250 a month to my Roth IRA and we are going to start setting up something similiar for Mel.

CashWe have very little cash reserves because in case of emergency we would rely on our credit to get us over some hurdles while we cash in some stock.

Real EstateWe were really interested in real estate for a while and spent a lot of time at B&N reading real estate investment books. We went through on a deal for a 2br 2ba condo with some family and while it hasn't been a huge success it has been a good learning experience. We are currently working on another deal but with so many people crowding the market it takes longer to find a good deal. We've got about $15,000 locked away in the investment property...

Mutual FundsIf you don't have a lot of time or don't want to follow stocks then put some money into mutual funds. I only maintain mutual funds in my retirement accounts and my foundation account. Melanie does not follow the market as closely as I do and has 99% of her taxable portfolio invested in mutual funds. She is not willing to take on as much as risk as I am and she doesn't want to track the market...

StocksI contribute 10% automatically to my company's ESPP. I have not been allocating additional $ to my stock portfolio. I have been fortunate enough in the past few years to actually have positive growth(have grown from $20,000 to $30,000 and withdrawn some too). I spend a good amount of time keeping an eye on the market. I like it but at the same time I am getting tired so I am thinking about converting to mutual funds in the next year or so.

$ we never see on from our paychecks:

Retirement contributions and the ESPP.

$ from take home pay after bills and expenses:

$3k annually to Roth(trying to budget another $3k for Mel). We put the rest of our extra cash into mutual funds and we are constantly on the look out for good real estate deals.

Bottom line:

Automatically saving 10% for retirement via 401k

Automatically saving $3k in Roth

Automatically saving 10% after tax income in ESPP

Rest goes to Mel's mutual funds, if there is any.